Payroll in Turkey

Payroll in Turkey: Comprehensive Guide to Taxes & Regulations

Payroll in Turkey is a vital component of business operations, particularly for companies managing a local workforce. Understanding Turkish payroll regulations, taxes, and social security contributions is crucial for compliance and avoiding legal issues. In this comprehensive guide, we’ll cover all aspects of payroll in Turkey, including tax regulations, social security contributions, and important considerations for employers.

Table of Contents

Key Aspects of Payroll in Turkey

1. Employee Classification

In Turkey, employees are typically classified as either full-time, part-time, or temporary. Each classification comes with specific rules regarding working hours, wages, and benefits. Employers need to determine employee status to apply the appropriate tax and social security deductions.

- Full-time employees: Expected to work 45 hours per week, and entitled to overtime pay if they exceed this limit.

- Part-time employees: Paid proportionally to the hours they work.

- Temporary employees: Work for a fixed period with a temporary employment contract, subject to the same tax and social security deductions.

2. Minimum Wage

Turkey enforces a national minimum wage, which is updated annually. As of 2024, the gross monthly minimum wage in Turkey is TRY 17,002.12. Employers must ensure that all full-time employees are paid at or above this rate to comply with local labor laws.

3. Taxation in Payroll

Payroll taxation in Turkey consists of several components, including income tax, stamp tax, and social security contributions. Minimum wage workers are exempt from these taxes.Here’s a breakdown of these taxes:

- Income Tax: Turkish income tax is progressive, with rates ranging from 15% to 40% depending on income brackets. Employees’ salaries are subject to withholding tax, which the employer must deduct and remit to the government.

- Stamp Tax: A standard stamp tax is levied at 0.759% on gross wages.

4. Social Security Contributions

Turkey has a mandatory social security system, managed by the Social Security Institution (SGK). Both employers and employees are required to contribute a percentage of the employee’s salary to social security funds.

- Employer Contributions: Employers contribute approximately 22.5% of the employee’s gross salary toward social security, which includes old-age pension, health insurance, and unemployment insurance.

- Employee Contributions: Employees contribute 15% of their gross salary.

- Government Contributions: In Turkey, the government contributes 1% to unemployment premiums,

These contributions cover the following benefits:

- Health insurance

- Maternity and sickness leave

- Old-age pensions

- Disability pensions

- Unemployment benefits

5. Social Security Reductions

- For employers who do not have any premium debts, 5% support is provided by the treasury based on their total contributions.

- For employers who sending workers from Turkey to work in workplaces abroad, a 5% support is provided by the treasury on the general health insurance contributions.

Do you need more info? Click then: Turkish Social Security System

6. Tax Exemptions & Reductions

- Minimum Wage Exemptions: The Minimum Wage in Turkey is excluded from tax, and income and stamp duty are not deducted from the minimum wage. This exemption is applied to other wage earners who earn salaries above the minimum wage, up to the amount of their income corresponding to the minimum wage, thereby aiming to ensure equality.

- Disability Reduction: In Turkey, disabled employees with a disability degree of more than 40% are subject to an Income Tax Deduction called Disability Discount. The scope of the discount depends on the degree of disability and other relevant factors. The discount is deducted from the taxable income of disabled employees, thus reducing income tax.

- Other Reductions: In Turkey; some allowances, such as meal,transportation, warming, lighting allowances, may not be or may be partially subject to social security or income tax.The exact treatment of these allowances can vary, so it’s benefit for you to hit a Turkish Social Security Advisor who gets know deeply the specific rules governing each type of allowance.

Payroll Management in Turkey

Payroll Management in Turkey requires navigating a complex set of parameters crucial for compliance and accuracy. Vigilance in these areas is essential for both employers and employees to ensure precise payroll calculations and adherence to local regulations.

Employers in Turkey are required to process payroll on a monthly basis. Employers are responsible for deducting income tax, stamp tax, social security contributions, health insurance premiums, unemployment premiums, pensions, and any other mandatory deductions directly from employees’ salaries.

These deductions must then be submitted to the Tax Office and Social Security Institution (SGK) by employer. It is imperative for employers and employees alike to keep a close eye on these parameters to ensure accurate payroll calculations and maintain compliance with local regulations.

1. Payroll Processing

Payroll processing in Turkey involves several key steps:

- Calculate Gross / Net Salary: Including any bonuses, overtime, or allowances.

- Deduct Taxes: Income & stamp tax.

- Implement Social Security Contributions: The employee’s contribution typically amounts to around 15% of their gross salary, while the employer’s contribution is approximately 22.5%.

- Submit reports: Provide necessary payroll reports to tax office and SGK.

2. Payroll Parameteres

- Gross Salary: In Turkey, gross salary encompasses an employee’s total earnings prior to any deductions, such as taxes and social security contributions. This includes base salary, overtime pay, bonuses, and other forms of compensation. The gross salary serves as the starting point for all payroll calculations. Gross Salary refers to the amount of salary which is earned by employees according to Turkish Labor Law.

- It is calculated such as; Gross Salary = Net Salary + Total Deductions (Social Security Premium Employee’s Share (including Unemployment Insurance) + Income Tax + Stamp Tax)

- Net Salary: Net salary denotes the amount an employee ultimately receives after all deductions have been subtracted and additions have been accounted for from the gross salary. Deductions typically consist of income tax, social security contributions, and other mandatory withholdings. It represents the actual amount that employees take home. It is calculated such as;

- Net Salary = Gross Salary – Total Deductions + Total Additions

- Income Tax Withholding: Income Tax in Turkey is progressive, with rates ranging from 15% to 40% based on the employee’s income level. Minimum Wage in Turkey earners are exempt from income tax. To calculate Income Tax in Turkey, the first step is to determine the taxable income, which is derived by subtracting the employee’s share of social security premiums from the gross salary. The Income Tax is then computed by applying the relevant income tax rate to the taxable income.

- Stamp Tax: It is calculated as 0.759% on the gross wage, minimum wage earners are also exempt from stamp duty.

- Stamp tax is calculated such as;Stamp Tax = Gross Salary * Stamp Tax Rate

- Social Security Contubutions: Social Security Premium Contributions are applied to the payroll at the following rates;

Employer Contributions: 22.5%

Employee Contributions: 15%

Government Contributions: 1%

- Bonuses and Additional Payments: While there is no statutory requirement to pay bonuses in Turkey, it’s common practice to offer performance-based bonuses, especially in industries like finance and technology. Employers may also provide additional payments such as holiday allowances or end-of-year bonuses, which are subject to taxation and social security deductions.

- Overtime: The standard workweek in Turkey is 45 hours, typically spread over six days. Employees working more than 45 hours are entitled to overtime pay at a rate of 1.5 times the regular hourly wage. Turkish labor law allows a maximum of 270 hours of overtime per year for each employee.

3. Leaves

In Turkey, employees are entitled to various types of leave:

- Annual Leave: Employees in Turkey are entitled to paid annual leave, which increases based on the length of service:

- Up to 1 year of service: No entitlement

- 1 to 5 years: 14 days of paid leave

- 5 to 15 years: 20 days of paid leave

- More than 15 years: 26 days of paid leave

- Sick Leave: Employees can take sick leave if they provide a doctor’s note. The Social Security Institution (SGK) compensates a portion of the salary for extended sick leave.

- Maternity Leave: Female employees are entitled to 16 weeks of paid maternity leave, split equally before and after childbirth. Fathers are granted 5 days of paternity leave.

- Public Holidays: There are several public holidays in Turkey, during which employees are entitled to paid leave. These include:

- New Year’s Day

- National Sovereignty and Children’s Day (April 23)

- Labor and Solidarity Day (May 1)

- The Democracy and National Unity Day (July 15)

- Republic Day (October 29)

- Religious holidays such as Eid al-Fitr and Eid al-Adha

If employees are required to work on public holidays, they are entitled to overtime pay at double their regular rate.

4. Compensations

- Termination Pay: When an employee is terminated, employers must comply with local labor laws regarding notice periods and severance pay. The notice period depends on the employee’s length of service:

- 0-6 months: 2 weeks’ notice

- 6 months to 1.5 years: 4 weeks’ notice

- 5 to 3 years: 6 weeks’ notice

- 3+ years: 8 weeks’ notice

- Severance Pay: Employees who have completed at least one year of service are entitled to severance pay. The severance payment is equivalent to one month’s salary for each year of service.

5. Additional Considerations for Foreign Employees

Foreign employees working in Turkey are subject to the same payroll regulations as Turkish citizens, but there are some additional considerations:

- Work Permits: Foreign employees must obtain a work permit before they can be legally employed in Turkey. Employers are responsible for securing these permits on behalf of their employees.

- Tax Residency: Foreign employees who spend more than six months in Turkey are considered tax residents and are subject to the same income tax rates as local employees. Those who spend less than six months are only taxed on their Turkish-sourced income.

Do you need more info? Click then: Turkey Work Visa

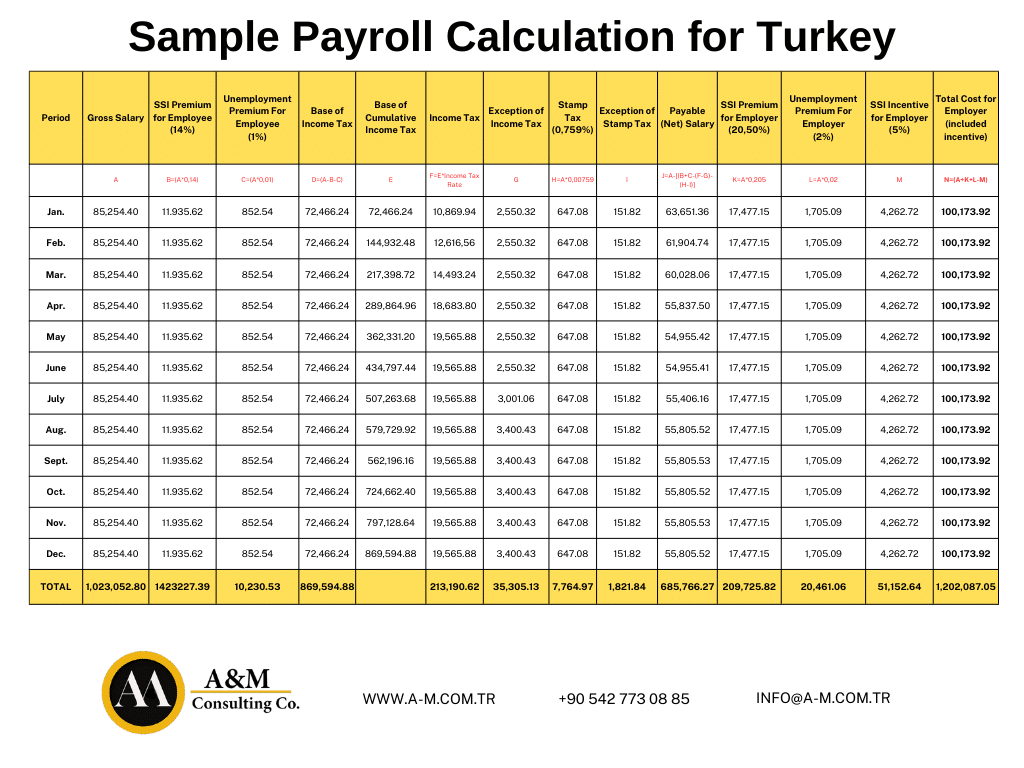

Sample Payslip Calculation in Turkey

You can find a sample payroll for an employee with a monthly gross wage of 85,254.40 TRL, calculated based on the specified parameters. Upon examining the payroll, it is evident that the employee’s net wage varies each month due to the progressive tax tariff.

Salary Payment Models in Turkey

Salary payment models in Turkey typically involve regular monthly payments but can vary depending on the nature of the job and the industry.

Payments in Turkey are usually made on a monthly basis unlike many other countries. Employees receive their salary once a month through bank transfer directly to their bank account. The exact payment date generally falls at the end of the month or within the first week of the following month, although it may vary depending on the company.

Here are the most common payment models:

- Monthly Payment: Monthly salary payment is the predominant model in Turkey. Employees are typically paid once a month, usually on the last working day of the respective month. Payments are mandated to be conducted via bank transfer.

- Eid Payment: Some employment contracts include an Eid bonus payment, commonly known as the “Eid Bonus” for Ramadan and Sacrifice Bayram. This bonus, equivalent to one month’s salary, is usually disbursed on the eve of the related Eid.

- Bonus Payment: Awards can be granted based on various criteria, such as performance, company profits, or individual achievements. Bonuses are typically paid periodically and may be outlined in the employment contract or determined by company policies.

- Commission Payment: In roles involving sales or positions where employees receive a percentage of sales revenue, commissions are often a significant part of the compensation package. Commissions are typically paid in addition to the base salary and may be disbursed monthly, quarterly, or annually. This is particularly common in the retail and construction sectors.

FAQs About Payroll in Turkey

Payroll in Turkey typically includes gross salary, social security contributions, unemployment insurance, income tax, and additional allowances or deductions.

The minimum wage is determined by the government and is updated periodically. As of 2024, the gross minimum wage is TRY 20.002,50 per month, but this may change, so it’s essential to verify the latest figures. The NET minimum wage is TRY 17.002,12

Employers and employees must make social security contributions (SGK). Employers contribute approximately 22.5% of the employee’s gross salary, while employees contribute around 15%.

Income tax in Turkey is progressive, starting at 15% and increasing to 40% based on salary levels. Taxes are deducted directly from employees’ wages by employers.

Yes, 3% unemployment insurance is mandatory. Employers contribute 2% of the gross salary, employees contribute 1% and sate contribute 1%.

Employers must register new employees with the Social Security Institution (SGK) within one month of their start date. Failure to do so can result in fines.

Employees are entitled to severance pay after one year of continuous employment. Severance is calculated as 30 days of gross salary for each year worked.

Overtime is typically paid at 150% of the regular hourly wage. The maximum number of overtime hours allowed is 270 per year.

Employers must submit monthly payroll reports to the Social Security Institution (SGK) and the Tax Office. These include details of wages, contributions, and tax withholdings.

Payroll is typically processed monthly, with wages due at the end of each month unless otherwise stated in the employment contract.

Employees are entitled to annual leave, public holidays, meal allowances, and in some cases, bonuses, depending on the company policy or collective bargaining agreements.

Bonuses and other variable payments are subject to the same tax and social security contributions as regular wages.

Employees on sick leave are entitled to receive sick pay from the Social Security Institution after two days of absence, but not for the first two days.

Maternity leave is 16 weeks in total (8 weeks before and 8 weeks after birth). During this period, the Social Security Institution pays a portion of the employee’s salary.

Expatriates working in Turkey are subject to the same payroll regulations as Turkish employees and they also subject to Work Permit regulations.

Outsource Payroll Services in Turkey

Many companies, especially multinational corporations, opt to outsource payroll in Turkey to ensure compliance with local regulations and reduce administrative burdens. Payroll outsourcing providers can manage everything from salary calculations and tax deductions to social security contributions and reporting.

Outsourcing payroll services can offer the following advantages:

- Compliance with Turkish regulations

- Time savings for HR and finance teams

- Accuracy in tax and social security calculations

- Prevent of fine

- Reduction of administrative workload

Get in Touch for Outsource Payroll Services in Turkey

We offer at A&M Consuting Co. end to end offordable and reliable HR and Payroll Services, with our team of stands poised to adeptly manage all facets of your company’s Human Resources & Payroll Processes

Our talented and qualified consultants with SGK background offer you a comprehensive range of services, including but not limited to:

- Management of Human Resources Prosedures

- Social Security Registration

- Payroll Management

- Recruitment Prosedures(candidate selection – evaluation – assignment)

- Pensions & Benefits

- Work Permit

As A&M Consulting Co. We continue to guide and lead global and corporate investors and individual enterprenuers who is willing to Invest or willing to extent theirs inevst in Turkey with our services of Human Resources Consulting which full compliance with the Turkish Social Securty System,

DISCOVER OUR SERVICES:

- Company Registration in Turkey

- Accounting & Bookeeping Services

- HR & Payroll Services

- Business Consultancy for Turkey

- Social Security Registration

- Virtual Office & Legal Address in Turkey

- Turkish Citizenship

- Turkey Work Visa

- Turkey Investment Visa

- Turkiye Tech Visa

- Establishment of Association in Turkey

- Foundation Registration in Turkey

- Company Winding Up in Turkey

You can reach out to our experienced consultans via email or by filling out the Contact Form on our website’s contact page.