Tax Registration in Turkey

Tax Registration in Turkey: Comprehensive Guide for Business

Establishing a business in Turkey requires compliance with the country’s tax regulations. One of the fundamental steps is registering for tax purposes. This guide provides a comprehensive overview of the tax registration process in Turkey, ensuring that businesses can operate legally and efficiently.

Table of Contents

Who Needs to Register for Tax in Turkey?

Tax registration in Turkey is mandatory for various entities and individuals engaging in economic activities within the country. Understanding who needs to register for tax helps ensure compliance with Turkish tax laws and regulations.

All entities and individuals engaging in commercial activities in Turkey are required to register for tax. This includes:

1. Individuals (Personal Income Tax)

- Residents: Individuals who reside in Turkey for more than six months in a calendar year are considered tax residents. They are required to register for tax and declare their worldwide income.

- Non-Residents: Individuals who earn income from Turkish sources, even if they do not reside in Turkey, must register and pay taxes on their Turkey-sourced income.

2. Companies (Corporate Income Tax)

- Local Companies: All companies incorporated in Turkey must register for corporate tax. This includes limited liability companies (LLCs), joint-stock companies, and other forms of business entities.

- Foreign Companies: Foreign companies with a permanent establishment or a significant presence in Turkey, such as branches, representative offices, or subsidiaries, must register for corporate tax.

3. Self-Employed Individuals and Freelancers

Self-employed individuals and freelancers who provide services or conduct business activities in Turkey must register for tax and report their earnings.

4. Employers(Withholding Tax)

Employers who hire employees in Turkey are required to register for tax to handle payroll taxes, including withholding taxes on employee salaries, social security contributions, and unemployment insurance.

5. VAT-Paying Entities

- Businesses: Any business entity, including individuals, partnerships, and corporations, engaging in the sale of goods or provision of services subject to Value Added Tax (VAT) must register for VAT.

- Importers: Entities importing goods into Turkey must register for VAT to comply with customs and tax regulations.

6. Investors

Individuals or entities earning income from investments in Turkey, such as dividends, interest, or rental income from property, need to register for tax purposes.

7. Property Owners

Owners of real estate in Turkey must register for property tax, which includes residential, commercial, and land properties. This applies to both Turkish and foreign property owners.

8. Legal Entities

Entities such as associations, foundations, and cooperatives engaging in economic activities are required to register for tax.

Types of Taxes in Turkey

Turkey has a comprehensive tax system that includes various types of taxes levied on individuals, corporations, and goods and services. Understanding the different types of taxes in Turkey is crucial for compliance and effective financial planning. Here is an overview of the primary taxes in Turkey:

1. Income Tax

- Personal Income Tax: Levied on the income of individuals, including wages, salaries, business income, and other sources of income. Tax rates are progressive, ranging from 15% to 40% based on income levels.

- Corporate Income Tax: Applied to the profits of companies operating in Turkey. The standard corporate tax rate is 25%.

2. Value Added Tax (VAT)

VAT is a significant source of revenue for the Turkish government and is levied on the supply of goods and services. The standard VAT rate is 18%, with reduced rates of 8% and 1% applicable to specific goods and services, such as basic food items and medical products.

3. Special Consumption Tax (SCT)

SCT is imposed on certain goods that are considered luxury items or have a high social cost. These goods include petroleum products, vehicles, alcohol, tobacco, and luxury consumer goods. The tax rates vary depending on the type of product.

4. Withholding Tax

Withholding tax in Turkey is a mechanism where the tax is deducted at the source of income by the payer, instead of being paid directly by the recipient.This system ensures that the tax authorities receive tax revenue in a timely and efficient manner.

I) Scope of Withholding Tax

Withholding tax in Turkey applies to various types of income, including but not limited to:

- Dividends: Income from shares or other equity participations.

- Interest: Income from loans, deposits, and other interest-bearing financial instruments.

- Royalties: Payments for the use of intellectual property, such as patents, trademarks, and copyrights.

- Rental Income: Income from leasing property, both movable and immovable.

- Professional Services: Payments for consultancy, accounting, legal, and other professional services provided by individuals or entities.

- Employment Income: Salaries and wages paid to employees.

II) Withholding Tax Rates

The rates for withholding tax vary depending on the type of income and the residency status of the recipient. Some of the common withholding tax rates include:

- Dividends: 10%

- Interest: 7,5% for resident entities, 0% for non-residents on certain financial instruments

- Royalties: 20%

- Rental Income: 20%

- Professional Services: 20%

- Employment Income: Progressive rates ranging from 15% to 40% based on the level of income.

5. Motor Vehicle Tax (MVT)

MVT is an annual tax levied on motor vehicles registered in Turkey. The tax amount depends on the age, engine capacity, and type of vehicle.

6. Property Tax

Property tax is levied on real estate properties, including residential, commercial, and land properties. The tax rates are determined by the local municipalities and are generally calculated as a percentage of the property’s assessed value.

7. Inheritance Tax

This tax is levied on the transfer of property through inheritance. The rates are progressive, ranging from 1% to 30%, depending on the relationship between the donor and the recipient and the value of the inheritance.

8. Stamp Duty

Stamp duty is applied to a variety of documents, including contracts, pay slips, agreements, financial transactions, and official documents. The rates vary depending on the type of document and the transaction amount.

9. Banking and Insurance Transactions Tax (BITT)

BITT is levied on the transactions of banks and insurance companies. The standard rate is 5%, but it can be reduced for certain transactions, such as interest on deposits and foreign exchange transactions.

10. Customs Duties

Customs duties are levied on imported goods. The rates vary depending on the type of product and its country of origin, in accordance with Turkey’s trade agreements and customs regulations.

11. Environmental Tax

This tax is imposed on certain activities and products that have an environmental impact, such as waste management services and plastic packaging. The rates vary based on the type of activity or product.

12. Valuable Housing Tax

Valuable Housing Tax, also known as “Değerli Konut Vergisi” in Turkish, is a tax levied on high-value residential properties in Turkey as rates ranking from 0,3% to 1%.

This tax was introduced to address wealth distribution and generate additional revenue from luxury real estate properties.

Who Needs to Register for Tax in Turkey?

Tax registration in Turkey is mandatory for various entities and individuals engaging in economic activities within the country. Understanding who needs to register for tax helps ensure compliance with Turkish tax laws and regulations. Here is a breakdown of those required to register for tax in Turkey:

1. Individuals (Personal Income Tax)

- Residents: Individuals who reside in Turkey for more than six months in a calendar year are considered tax residents. They are required to register for tax and declare their worldwide income.

- Non-Residents: Individuals who earn income from Turkish sources, even if they do not reside in Turkey, must register and pay taxes on their Turkey-sourced income.

2. Companies (Corporate Income Tax)

- Local Companies: All companies incorporated in Turkey must register for corporate tax. This includes limited liability companies (LLCs), joint-stock companies(JSCs), and other forms of business entities.

- Foreign Companies: Foreign companies with a permanent establishment or a significant presence in Turkey, such as branches, representative offices, or subsidiaries, must register for corporate tax.

3. Self-Employed Individuals and Freelancers (Freelancers Income Tax)

Self-employed individuals and freelancers who provide services or conduct business activities in Turkey must register for tax and report their earnings.

4. Employers(Withholding Tax)

Employers who hire employees in Turkey are required to register for tax to handle payroll taxes, including withholding taxes on employee salaries, social security contributions, and unemployment insurance.

5. VAT-Paying Entities

- Businesses: Any business entity, including individuals, partnerships, and corporations, engaging in the sale of goods or provision of services subject to Value Added Tax (VAT) must register for VAT.

- Importers: Entities importing goods into Turkey must register for VAT to comply with customs and tax regulations.

6. Investors

Individuals or entities earning income from investments in Turkey, such as dividends, interest, or rental income from property, need to register for tax purposes.

7. Property Owners

Owners of real estate in Turkey must register for property tax, which includes residential, commercial, and land properties. This applies to both Turkish and foreign property owners.

8. Legal Entities

Entities such as cooperative engaging in economic activities are required to register for tax.

Steps for Tax Registration in Turkey

1. Obtain a Tax Identification Number (TIN)

The first step in tax registration is obtaining a Tax Identification Number (TIN) from the Turkish Revenue Administration. This number is essential for all tax-related activities.

- For Individuals: Apply in person at a local tax office with your passport or Turkish ID.

- For Businesses: Submit the application through the tax office with the necessary business registration documents.

2. Register with the Trade Registry

Businesses must register with the Turkish Trade Registry. This involves submitting the articles of association, notarized signatures of founders, and other required documents. Upon registration, the company receives a registration number.

3. Complete the Tax Registration Form

Fill out the tax registration form provided by the local tax office. This form requires details about the business, including its legal structure, address, and the nature of its activities.

4. Submit Required Documents

Submit the completed tax registration form along with the following documents:

- Copy of the Trade Registry Gazette (for companies)

- Articles of Association

- Notarized signatures of company representatives

- Lease agreement or title deed for the business premises

- Copies of identification documents (passports or Turkish IDs) of company representatives

5. Obtain the Tax Certificate

Upon successful registration, the tax office issues a tax certificate. This certificate must be displayed at the business premises and is required for various business transactions.

Post-Tax Registration Compliance With Turkish Legislation

Once registered, businesses must comply with ongoing tax obligations:

- File Tax Returns: Submit periodic tax returns (monthly, quarterly, and annually) as required.

- Maintain Records: Keep accurate records of all financial transactions, invoices, and receipts.

- Reporting: Report your financial statements to the tax office periotly.(Profit-Loss Statement, Balance Sheet)

- Pay Taxes: Ensure timely payment of all taxes to avoid penalties and interest.

- Comply with Audits: Be prepared for potential tax audits by maintaining proper documentation.

Make your Tax Registration in Turkey Through A&M Consulting Co.

Tax Registration in Turkey is essential for compliance and avoiding legal penalties. Whether you are an individual, a business, or a property owner, understanding the tax registration requirements is crucial for anyone looking to conduct business in Turkey.

By understanding the requirements and following the correct procedures, businesses & investors can ensure compliance with Turkish Tax Laws and focus on their operations.

Seeking professional advice is recommended to ensure that you meet all legal obligations and take advantage of any Tax benefits or incentives available in Turkey.

As a Turkish Business Consulting Firm; A&M Consulting Co. is an essential business partner for global investors & individual entrepreneurs who are willing to invest or extend theirs business in Turkey ,

From compliance and reporting of tax to strategic tax planning, A&M Consulting Co. offers Tax Registration Services in Turkey that can save time, reduce costs, and provide peace of mind.

By choosing us as the right consultant, you can get rid of the complexity of Turkish tax legislation and benefit from all tax incentives efficiently.

We are in your side for reputable Tax Registration Services in Turkey.

A&M Consulting Co. as a Turkish Accounting & Tax Consulting Firm specializes on end to o end performing Tax Registration Services, Accounting & Tax Consulting Services for particularly foreign investors and corporate companies in Turkey.

We continue to offer solutions for companies, particularly foreign investors, to facilitate their smooth and swift entry into the Turkish market, ensuring full compliance with local legislation.

DISCOVER OUR SERVICES:

- Company Registration in Turkey

- Tax Services

- Accounting & Bookeeping Services

- HR & Payroll Services

- Business Consultancy for Turkey

- Social Security Registration

- Turkish Citizenship

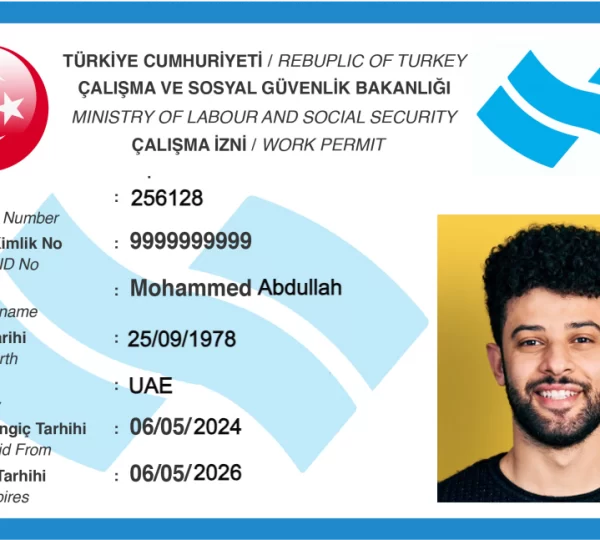

- Turkey Work Visa

- Turkiye Tech Visa

- Establishment of Association in Turkey

- Foundation Registration in Turkey

- Company Winding Up in Turkey

You can reach out to our experienced consultans via email or by filling out the Contact Form on our website’s contact page.

FAQs About Tax Registration in Turkey

Tax registration is the process of registering with the Turkish tax authorities to obtain a taxpayer identification number (TIN) for individuals or businesses.

All individuals and businesses earning income in Turkey, including residents, non-residents, and foreign companies, must register for tax.

You can register for tax by visiting the local tax office, submitting the required documents, and applying for a taxpayer identification number (TIN).

ommon documents include a valid ID or passport, proof of address, and for businesses, company registration details and trade registry information.

The process typically takes a few days once all necessary documents are submitted to the local tax office.

Yes, foreigners with income sources in Turkey can register for tax and obtain a TIN. They will need to provide relevant identification and residency documentation.

Yes, all businesses operating in Turkey, whether local or foreign-owned, must register for tax and comply with Turkish tax laws.

Common taxes include income tax, corporate tax, value-added tax (VAT), withholding tax and special consumption tax, depending on the type of income or business activity.

Some aspects of tax registration, particularly for businesses, may be initiated online, but in most cases, a visit to the local tax office is required for completion.

Failure to register for tax can result in penalties, fines, and legal consequences. It is essential to comply with the tax registration requirements promptly.

Recent Posts