Taxpayer Identification Number in Turkey

Taxpayer Identification Number in Turkey: Extensive Guide

A Taxpayer Identification Number (TIN), or Vergi Kimlik Numarası in Turkish, is a unique identifier issued to individuals and legal entities for tax purposes in Turkey.

Whether you are a resident or non-resident, obtaining a TIN is essential for engaging in various financial and legal activities, including opening bank accounts, buying property, starting a business, or fulfilling tax obligations.

In this comprehensive guide, we’ll cover everything you need to know about the Taxpayer Identification Number in Turkey, including how to obtain it, its uses, and related procedures.

Table of Contents

What is a Taxpayer Identification Number (TIN) in Turkey?

A Taxpayer Identification Number is a 10-digit unique number issued by the Turkish Revenue Administration. It serves as a mandatory identifier for both individuals and corporations that engage in activities subject to taxation in Turkey.

The TIN is required for:

- Filing income tax returns.

- Opening bank accounts.

- Purchasing real estate.

- Registering a business.

- Participating in financial transactions like buying stocks or bonds.

- Other official legal and financial processes.

Who Needs a Tax Number in Turkey?

- Turkish Citizens: Automatically receive a Turkish Identification Number (T.C. Kimlik Numarası) that also serves as their TIN.

- Foreigners: Foreign nationals who conduct taxable activities in Turkey must apply for a TIN.

- Companies and Legal Entities: Corporations, partnerships, and other legal entities operating in Turkey must also obtain a TIN for tax registration.

How to Obtain a Taxpayer Identification Number in Turkey

For Foreign Individuals

Foreign individuals who need a TIN for tax purposes can easily apply by following these steps:

Visit a Tax Office:

- Go to the local Tax Office (Vergi Dairesi) in the city where you are residing or conducting business.

Required Documents:

- Valid Passport: Foreigners need to present their passport for identification.

- Residence Permit (if applicable): Required for foreigners residing in Turkey.

- Application Form: Complete the TIN application form at the tax office.

Online Application (for Non-Residents):

- Foreigners who are not residents in Turkey but need a TIN for specific transactions, such as property purchases, can apply for a TIN online through the Interactive Tax Office (İnteraktif Vergi Dairesi) portal.

Issuance of TIN:

- Once your application is processed, your TIN will be issued immediately. There are no fees for obtaining a TIN.

For Companies and Legal Entities

Companies and other legal entities in Turkey can apply for a TIN during the business registration process. The company’s TIN will be required for tax filings, payroll, VAT registration, and other corporate activities.

Documents required for companies:

- Articles of Incorporation.

- Trade Registry Gazette.

- Business registration form.

What is the Purpose of a Taxpayer Identification Number in Turkey?

The TIN is crucial for various tax and legal procedures in Turkey. Here are some of its key uses:

Tax Filing:

- Individuals and corporations must use their TIN when submitting income tax, corporate tax, or value-added tax (VAT) returns.

Banking and Financial Transactions:

- A TIN is necessary for opening bank accounts, transferring large amounts of money, or buying financial assets such as stocks and bonds.

Real Estate Transactions:

- Whether you’re purchasing, selling, or renting out property in Turkey, a TIN is required.

Starting a Business:

- Entrepreneurs and companies need a TIN to register their businesses with the relevant Turkish authorities.

Inheritance and Gifts:

- A TIN is needed when transferring or receiving inheritance and gifts in Turkey to determine applicable taxes.

TIN for Foreigners: Key Considerations

Foreigners planning to engage in financial activities in Turkey need to understand the following points:

Residency and Non-Residency:

- Non-residents may also need a TIN, especially for property purchases or bank transactions in Turkey. It is not exclusive to residents.

TIN for Property Purchase:

- Foreigners buying real estate in Turkey must have a TIN to complete the transaction. This number is used in registering the property with the Land Registry and is essential for paying property taxes.

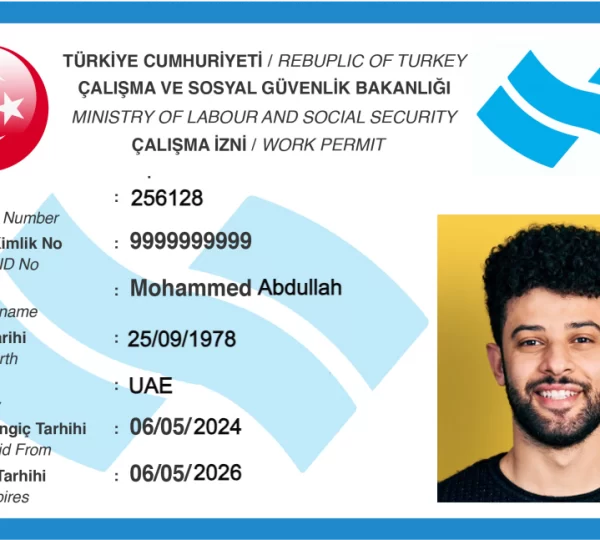

TIN for Employment:

- If a foreigner is working in Turkey, their employer will need the TIN for payroll processing and tax deductions.

TIN vs. Turkish ID Number:

- For Turkish citizens, the Turkish ID Number (T.C. Kimlik Numarası) may serves as their TIN. Foreigners, however, need to apply separately for a TIN.

How to Check or Retrieve a Taxpayer Identification Number in Turkey

Once you have been issued a TIN, it is important to keep it safe, as it will be required for all financial and tax-related activities. However, if you forget or lose your TIN, you can retrieve it through:

Interactive Tax Office Portal:

- Use the Interactive Tax Office online platform to look up your TIN by entering your personal information.

Visiting a Local Tax Office:

- You can also visit any local tax office in Turkey with your passport or Turkish ID to retrieve your TIN.

Penalties for Not Having a TIN

Failing to obtain or provide a valid TIN when required may lead to significant penalties. These penalties could include:

- Fines for failing to file tax returns.

- Delays in processing financial transactions such as real estate purchases.

- Inability to open bank accounts or engage in business activities.

Tax Obligations Once You Have a TIN

Obtaining a TIN does not automatically imply that you have tax obligations unless you earn taxable income in Turkey. However, you are responsible for ensuring that you meet the relevant tax requirements, including:

- Income Tax: Residents and non-residents earning income from sources within Turkey must file an income tax return.

- Corporate Tax: Businesses registered in Turkey are required to file corporate tax returns annually.

- VAT: If applicable, VAT must be filed and paid regularly by businesses.

Failure to comply with these obligations may lead to audits, penalties, or legal actions.

Reach Us to Get Tax ID Number in Turkey

The Taxpayer Identification Number (TIN) in Turkey is a crucial component for both residents and non-residents engaging in any financial, legal, or business-related activity within the country.

Whether you are an individual looking to open a bank account or a foreigner purchasing property, understanding the TIN’s role and obtaining it efficiently is essential for complying with Turkish tax regulations.

For those unfamiliar with the process, it is advisable to seek assistance from a Turkish Tax Expert or a Turkish Accountant to ensure compliance with the local tax rules and make the most of the country’s opportunities.

A&M Consulting Co. is a Tax Consulting Company and Turkish Accounting Firm that specializes in end-to-end to have Tax ID Number especially for foreign individuals or global companies who would like tı invest in Turkey.

We continue to offer cost-effective solutions that will facilitate individual enterprenuers and global investors and companies who would like to invest in Turkey or want to extend theirs business in Turkey market smoothly and quickly, to fully comply with local legislation and to access and tax exemptions.

DISCOVER OUR SERVICES:

- Company Registration in Turkey

- Tax Services

- Accounting & Bookeeping Services

- HR & Payroll Services

- Business Consultancy for Turkey

- Social Security Registration

- Turkish Citizenship

- Turkey Work Visa

- Turkiye Tech Visa

- Establishment of Association in Turkey

You can reach out to our experienced consultans via email or by filling out the Contact Form on our website’s contact page.

FAQs About Taxpayer Identification Number (TIN) in Turkey

A TIN, or Vergi Kimlik Numarası, is a 10-digit number issued by the Turkish Revenue Administration for tax purposes.

Both Turkish citizens, foreigners engaging in financial activities, and companies operating in Turkey need a TIN for tax-related activities.

Foreigners can apply for a TIN by visiting a local tax office with their passport or by applying online via the Interactive Tax Office.

Foreigners need a valid passport and may also need a residence permit. Companies need business registration documents.

No, obtaining a TIN is free of charge.

A TIN is usually issued immediately upon application at a tax office.

Yes, non-residents can apply for a TIN online through the Interactive Tax Office portal.

A TIN is used for filing tax returns, opening bank accounts, buying property, and starting businesses in Turkey.

You can retrieve your TIN through the Interactive Tax Office portal or by visiting a local tax office with identification.

No, Turkish citizens use their Turkish Identification Number (T.C. Kimlik Numarası) as their TIN.

Yes, foreigners must have a TIN to buy or sell property in Turkey.

Penalties may include fines, delays in financial transactions, and inability to file tax returns.

Yes, non-residents earning income from Turkish sources, such as rental income, need a TIN.

Yes, companies receive their TIN during the business registration process in Turkey.

Yes, employers need their employees’ TINs for payroll and tax deductions.

Recent Posts