Company Registration in Turkey

Company Registration in Turkey: Easy Steps for Business Setup

Registering a company in Turkey is an attractive option for foreign investors and entrepreneurs looking to expand their business into new markets. With its strategic location between Europe and Asia, Turkey offers access to a vast consumer base and a dynamic economy. This article will provide a comprehensive guide on how to register a company in Turkey, covering the types of business entities, the registration process, and the benefits of doing business in the country.

Table of Contents

Benefits of Business Incorporation in Turkey

Turkey has become a significant destination for business expansion due to its strategic geographical location, growing economy, and investor-friendly policies. Here are some key reasons to consider business incorporation in Turkey:

- Strategic Location: Turkey’s unique position as a bridge between Europe and Asia provides easy access to multiple markets, including Europe, the Middle East, and Central Asia.

- Growing Economy: With one of the fastest-growing economies globally, Turkey offers numerous opportunities for businesses in various sectors.

- Investment Incentives: The Turkish government offers various incentives, including tax breaks, subsidies, and grants, particularly in sectors like technology, manufacturing, and renewable energy.

- Skilled Workforce: Turkey boasts a young and educated workforce, making it an ideal location for companies needing skilled labor.

- Ease of Doing Business: Turkey has simplified its company registration process, making it easier for foreign investors to start and operate a business.

Options for Commercial Areas to Setup a Company in Turkey

When establishing a company in Turkey, whether to choose the mainland or free zones or Technoparks depends on the company’s field of activity, goals and expectations. Three options have their own advantages and disadvantages.

The sector your company will operate in, the market you are targeting and your long-term strategy are the most important factors in determining whether you will choose the mainland or the free zone.

If you plan to focus on the local market and reach a wide range of customers, the mainland may be more suitable. However, if you are planning to establish an export-oriented company and want to benefit from tax advantages, the free zones may be a more attractive option for you.

Here are some factors to consider when evaluating the options:

1- Mainland Company

- Advantages:

- Wide Market Access: Easier access to all of Turkey and international markets.

- Operating in Different Sectors: Flexibility to operate in various sectors.

- Investment Incentives: There may be the opportunity to benefit from various investment incentives offered by the state.

- Credit Opportunities: Mainland companies have a wider range of options when it comes to obtaining loans and financing from banks.

- Disadvantages:

- Tax Liabilities: There may be higher tax rates compared to free zones.

2- Free Zone Company

- Advantages:

- Tax Advantages: Companies operating in free zones can generally be exempt from corporate taxes, income taxes, and customs duties. This can significantly reduce costs.

- Ideal for Export-Oriented Companies: Free zones are ideal for companies that plan to export. Companies that want to do most of their production and trade abroad may prefer these zones.

- Fast Import and Export Processes: Bureaucratic procedures in free zones can be faster and simpler, which speeds up business processes.

- Disadvantages:

- Restricted Access to Local Market: Companies operating in free zones may be subject to certain restrictions when selling directly to the Turkish domestic market.

- Focus on Specific Areas of Activity Only: Free zones are generally suitable for certain sectors or activities (e.g. manufacturing, technology, logistics). It may be more difficult to operate in other areas.

- Limited Settlement: The settlement areas in free zones are limited and it can be difficult to find a place when demand is high.

- More Complex Bureaucracy: The process of establishing a business in freezone companies can be more complicated and time-consuming.

3- Technopark Company

- Advantages:

- Tax Incentives:Companies operating in technoparks are generally exempt from corporate and income taxes. These tax incentives can help companies reduce their costs and increase their profitability.

- R&D and Innovation Support: Technoparks focus on R&D and innovation-focused projects. Companies can easily access the infrastructure and support needed to develop innovative projects in these environments.

- Qualified Workforce: Since technoparks work in collaboration with universities and research institutions, they provide access to a qualified and talented workforce. This is a great advantage, especially for companies operating in the fields of technology and engineering.

- Financing and Grant Opportunities: Companies located in technoparks can benefit from R&D incentives, grants and other financing opportunities provided by the state. Such supports facilitate the implementation of projects.

- Networking and Collaboration Opportunities: Technoparks create an ecosystem where companies and academic institutions in the same sector come together. This allows companies to establish new collaborations, increase knowledge sharing and develop joint projects.

- Export Potential: Technoparks provide a suitable environment for technology-focused companies to export. Access to foreign markets is facilitated and an international competitive advantage is provided.

- Disadvantages:

- High Entry Threshold: Certain criteria must be met in order to take place in technoparks. Criteria such as R&D projects, innovation potential and company profile can be decisive in the acceptance of applications.

- High Competition: There are many innovative and technology-focused companies in technoparks. This can create a high competitive environment among companies. Intensified competition among companies operating in the same sector can make it difficult to enter the market and grow.

- Location and Area Limitations: There are a limited number of office and laboratory spaces in technoparks. Especially for large and expanding companies, it may be difficult to find a place.

- High Rents and Costs: Office rents and other operational costs in technoparks can be higher compared to other regions. This can create a financial burden for small-scale enterprises.

- Restricted Sector Focus: Technoparks usually focus on specific sectors. For example, they may be focused on technology, biotechnology or software. This can be a disadvantage for companies that want to operate in different sectors.

- Bureaucracy: Operating in technoparks may require certain legal and bureaucratic processes. These processes can be time-consuming and complex, especially for small businesses.

Need more satisfied about the technoparks? So, click then Technology Parks in Turkey

Types of Legal Entitiy in Turkey

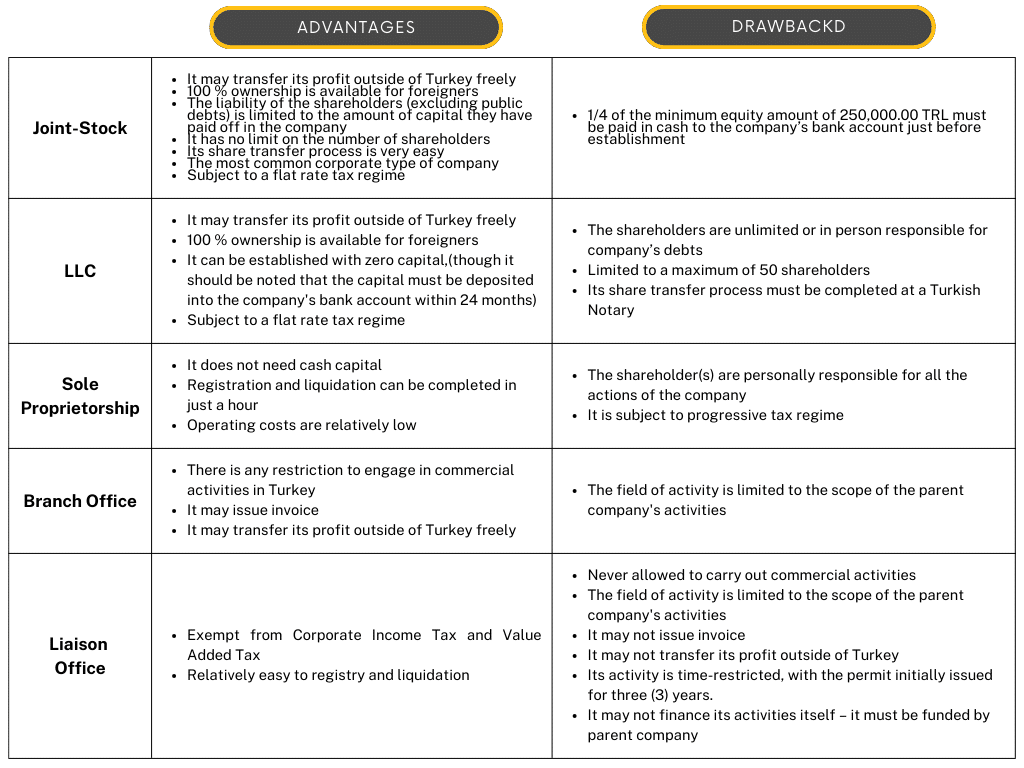

1. Joint Stock Company (JSC)

- Structure: Suitable for larger and more corporate businesses, a JSC is divided into shares. Shareholders’ liability (excluding public debts) is limited to their capital investment.

- Capital Requirement: Minimum capital is 250,000 TL, with 1/4 paid in cash to the company’s bank account before establishment. The remaining amount must be paid within 24 months.

- Benefits: No upper limit on the number of shareholders, preferred by banks and insurance companies, easier share transfers, and shares may be listed on the stock exchange.

Click the link for more info about JSC in Turkey

2. Limited Liability Company (LLC)

- Structure: Can have 1 to 50 shareholders.

- Capital Requirement: Minimum capital is 50,000 TL, payable within 24 months.

- Benefits: 100% ownership available for foreigners, immediate establishment with zero capital (to be deposited later), common type of equity company in Turkey.

- Responsibilities: One shareholder must be a manager; other directors can be from shareholders or non-shareholders.

Click the link for more info about LLC in Turkey

3. Sole Proprietorship Company

- Structure: Owned and operated by a single individual responsible for all debts and liabilities.

- Benefits: No cash capital required, quick registration and liquidation, low operating costs.

- Drawbacks: Owner is personally responsible for all actions and debts, subject to progressive tax regime.

4. Branch Office

- Structure: Allows foreign companies to engage in commercial activities in Turkey without establishing a new entity.

- Benefits: No minimum capital requirement, can commence business immediately, can issue invoices and transfer profits outside of Turkey.

- Drawbacks: Limited to the parent company’s scope of activities.

Click the link for more info about Branch Office in Turkey

5. Liaison Office

- Structure: Set up by foreign investors for research activities without commercial engagement.

- Benefits: Exempt from corporate income tax and VAT, relatively easy registration and liquidation.

- Drawbacks: Prohibited from commercial activities, cannot issue invoices or transfer profits, time-restricted operations (initially three years, extendable).

Click the link for more info about Liaison Office in Turkey

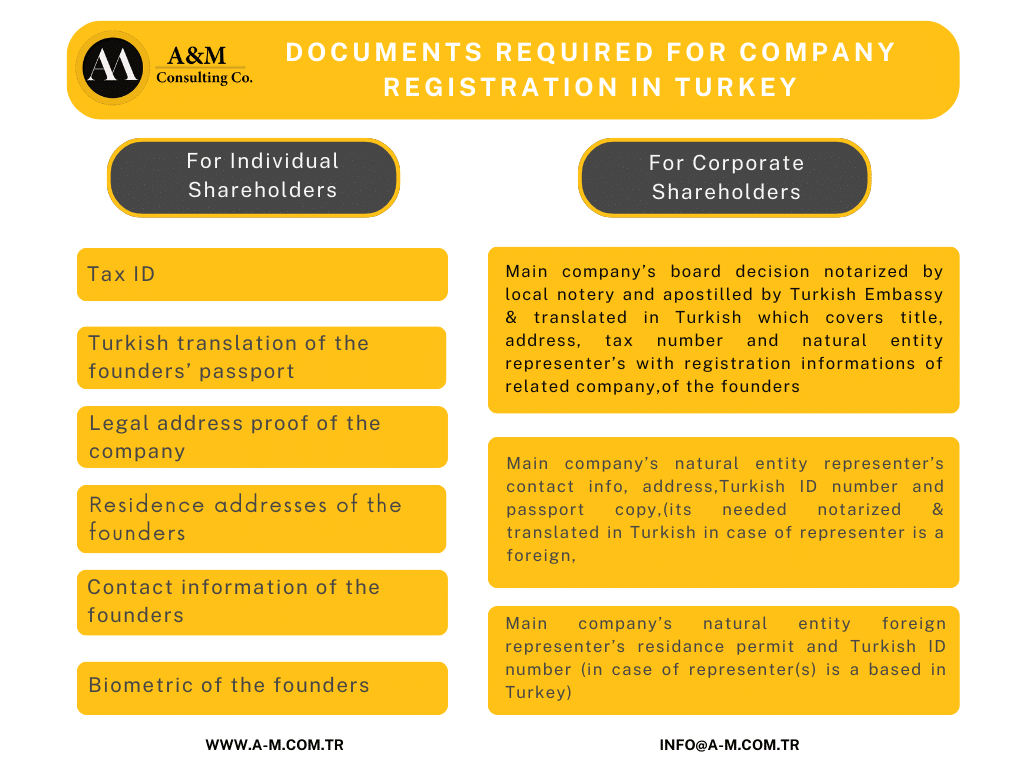

Required Documents for Turkey Corporate Registry

For Individual Shareholders:

- Tax ID

- Legal address proof of the company

- Turkish translation of passport

- Residence address

- Contact information

- Biometric data

For Corporate Shareholders:

- Legal address proof of the company

- Notarized and apostilled board decision of main company

- Representatives’ contact information, address, Turkish ID number, and passport copy

- Residence permit and Turkish ID number (if based in Turkey)

Comparison of Legal Entities in Turkey

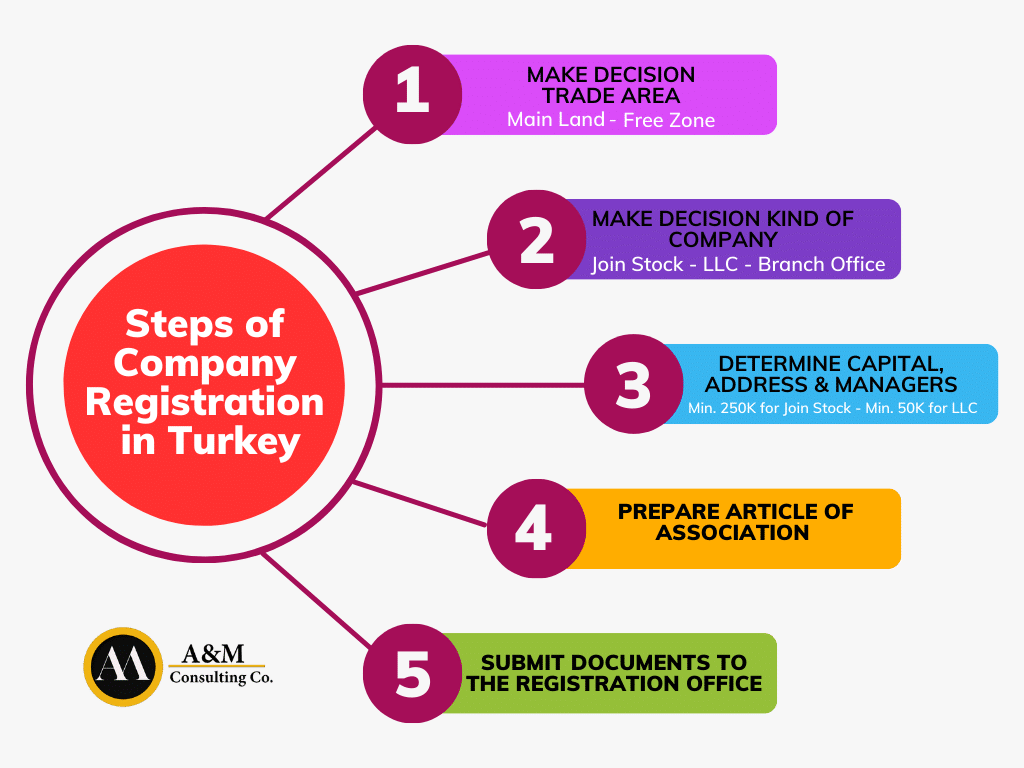

Steps to Start a Business in Turkey

- First Step: Determine the Trade Area: Choose between mainland or free zones.

- Second Step: Choose the Company Type: Decide between LLC or JSC.

- Third Step: Decide on Managers and Share Capital Amounts:

- For JSC: Minimum 250,000 TL, with 1/4 paid before establishment.

- For LLC: Minimum 50,000 TL.

- Fourth Step: Prepare the Articles of Incorporation:

- Reserve company title.

- Sign a lease contract for the legal address.

- Obtain tax ID numbers for founders.

- Translate and notarize founders’ passports.

- Fifth Step: Submit Documents:

- Submit all required documents and pay registration fees.

- Register with the tax office.

- Obtain a notarized signature circular for managers.

Cost of Company Formation in Turkey

Forming a company in Turkey typically costs around 4,000 EUR. This includes:

- Virtual office fee: 10 EUR/month

- Company formation services: Approximately 3,000 EUR

- Accounting and tax consultancy: Around 500 EUR/month

- Bank account opening services: 500 EUR/bank

Duration of Business Registration in Turkey

- For Shareholders in Turkey: 1-3 days for company formation, bank account opening, and online banking setup.

- For Shareholders Abroad: Longer setup process and higher costs for remote establishment.

Tax Registration for Companies in Turkey

Tax registration is last one of the company registration steps in Turkey. This is an essential step to ensure compliance with the Turkey’s legal and regulatory framework. Here’s the process and key considerations:

1. Obtain a Tax Identification Number (TIN)

Step 1: Company Registration

- Before tax registration, your company must be officially registered with the Trade Registry Office.

Step 2: Application for TIN

- Apply for a Tax Identification Number at the local tax office where your company is registered.

- Required Documents:

- Trade Registry Gazette indicating the company’s registration.

- Articles of Association of Company

- Copies of the identification documents (passports) of the company directors.

- Proof of address for the company’s headquarters.(Rent Agreement)

2. Value Added Tax (VAT) Registration

Step 1: Determine VAT Obligations

- All companies in Turkey are required to register for VAT. The standard VAT rate is 20%, with reduced rates of 1%, 8% and 10% applicable to certain goods and services.

Step 2: Submit VAT Registration Form

- Complete and submit the VAT registration form at the local tax office.

Step 3: VAT Number Issuance

- Upon approval, the tax office will issue a VAT number for your company.

3. Withholding Tax Registration

- Register for withholding tax if your company makes payments subject to withholding such as salaries, rent and certain types of professional services such as Accounting, Translate, Law

4. Corporate Income Tax Registration

- Companies operating in Turkey are required to pay a 25% tax on their profits. However, certain sectors benefit from reduced corporate income tax rates.

For further information, check out our article on Tax Registration in Turkey

Social Security Registration for Companies in Turkey

Register with the Social Security Institution (SGK) for social security contributions. This is mandatory for companies employing staff in Turkey.

Required Documents:

- Company registration documents.

- Identification documents of the directors.

- Employment contracts of the employees.

For further information, check out our article on Turkish Social Security System

Applying for Business Licenses

If your company in Turkey will engage in certain regulated activities, it is mandatory to complete the business licensing phase. This involves obtaining specific business licenses and permits from the relevant authorities overseeing the industry in which your company will operate. Here is an overview of the process and requirements for obtaining business licenses in Turkey:

1. Identify Industry-Specific Requirements

Step 1: Determine the Industry

- Identify the industry in which your company will operate. Common industries requiring special licenses and permits include:

- Health

- Education

- Insurance

- Financial services

- Manufacturing

Step 2: Research Regulatory Bodies

- Research the regulatory bodies and authorities responsible for issuing licenses in your specific industry. Each industry has its own set of regulations and requirements.

2. Prepare Required Documentation

Step 1: Gather Necessary Documents

- Compile the necessary documents for your license application. These may vary by industry but generally include:

- Company registration documents.

- Articles of Association.

- Identification documents of company directors.

- Proof of company address.

- Relevant qualifications or certifications of key personnel.

Step 2: Additional Industry-Specific Documents

- Depending on the industry, additional documents may be required, such as:

- Health industry: Medical licenses, facility inspections, compliance with health regulations.

- Education: Accreditation certificates, curriculum approvals, staff qualifications.

- Insurance: Financial statements, solvency requirements, regulatory compliance.

- Financial services: Capital adequacy, regulatory filings, operational guidelines.

- Manufacturing: Environmental impact assessments, safety protocols, production permits.

3. Submit the Application

Step 1: Complete Application Forms

- Fill out the appropriate application forms provided by the regulatory authority.

Step 2: Submit Application

- Submit your application along with all required documents to the relevant authority. This can often be done online or in person.

Step 3: Pay Application Fees

- Pay any applicable application fees. Fee amounts vary by industry and type of license.

4. Compliance and Inspections

Step 1: Compliance Checks

- Ensure your business complies with all regulatory requirements and standards set by the relevant authority.

Step 2: Site Inspections

- Be prepared for site inspections or audits by the regulatory body to verify compliance with industry-specific regulations.

5. Obtain the License

Step 1: Approval Process

- The regulatory authority will review your application and conduct any necessary inspections. If your application meets all requirements, it will be approved.

Step 2: License Issuance

- Once approved, you will receive your business license, allowing you to legally operate in your industry.

6. Ongoing Compliance

Step 1: Maintain Compliance

- Continuously comply with industry regulations and standards to avoid penalties or revocation of your license.

Step 2: Renewal of License

- Be aware of the expiration date of your license and ensure timely renewal by submitting the necessary documentation and fees.

Management of the Companies in Turkey

You can manage the company yourself or appoint a director. According to the Turkish Commercial Code, at least one manager is required, who can be a shareholder or an external appointee. If the manager is a legal entity, a natural person must be appointed to represent it. Foreign managers require a work permit.

Duties and Responsibilities of Managers

Managers are responsible for:

- Preparing financial statements and annual reports.

- Executing general assembly meeting decisions.

- Establishing the accounting system and conducting audits.

- Notifying the commercial court if the company is in debt.

Business Bank Account in Turkey

A bank account is essential for financial transactions, including share capital deposits, tax payments, and efficient financial management. Required documents include:

- Articles of Association

- Company registration certificate

- Tax registration certificate

- Company seal

- Wet signatures of representatives

- Residence permit (if representatives are based in Turkey)

For further information, check out our article on Corporate Bank Accounts in Turkey

Post-Incorporation Tasks

1- Register with the Tax Office

After completing the incorporation process, the first thing you need to do is register your company for tax purposes at the tax office associated with your company’s address. Although this process is usually done automatically by the trade registry office, it is recommended to verify and correct it if necessary. It is also advisable to obtain a user code and password for online transactions.

2- Register with the Social Security Institution (SGK)

The second step after incorporation is to register with the social security center associated with your company’s address and obtain an employer registration number, even if you do not employ any workers. This process is typically handled automatically by the trade registry office, but it is recommended to ensure that your workplace hazard class is correctly determined.

3- Hire a Certified Public Accountant (CPA) or Accountant

Sign a contract with a licensed CPA or accountant to handle your company’s accounting and tax-related matters. This is mandatory for ensuring your company’s legal compliance.

4- Open a Bank Account

It is recommended to open at least one bank account to manage the initial capital deposit during the incorporation phase, as well as post-incorporation tax and social security premium payments, and to efficiently handle your company’s operational payment and collection processes.

5- Apply for E-Ledger, E-Invoice, and Fiscal Stamp

As part of the digital transformation, it is mandatory to apply for e-ledger and e-invoice. To complete these applications, you need to obtain a fiscal stamp.

6- Prepare a Signature Circular

A signature circular is a notarized document that identifies the official representatives of a company and their authority to act on behalf of the company. This document is used to certify the authority of individuals who will conduct transactions on behalf of the company in official and legal processes. Examples of its use include:

- Opening bank accounts on behalf of the company.

- Submitting applications to official institutions.

- Signing contracts on behalf of the company.

- Handling tax office procedures.

- Conducting customs and international trade transactions.

7- Obtain a Company Stamp

Have a company stamp made to identify and approve your company’s official documents. Primary uses include:

- Standardizing company information on official documents.

- Verifying the company’s identity on paper invoices and receipts.

- Adding formality to legal and commercial contracts and processes.

- Supporting official transactions alongside signatures.

8- Apply for E-Notification

It is mandatory to apply for e-notification with the relevant institutions to receive legal notifications from the tax office and SGK.

9- Apply for Licenses & Permits

Depending on your field of activity, you are required to obtain a standard business license from the local municipality. Operating without a license may result in fines, legal actions, or even closure. Some sectors require additional special licenses beyond the standard business license. For example:

- Real Estate: Businesses involved in real estate brokerage and property valuation must obtain a Property Valuation Expertise Certificate and a Real Estate Broker License.

- Healthcare: Businesses operating aesthetic, oral and dental health, and hair transplant centers must obtain a Health Facility License from the Ministry of Health to operate legally.

- Construction: To engage in construction, some local or metropolitan municipalities require a Contractor Certificate from the Ministry of Environment and Urbanization.

- Telecommunications: Businesses operating in telecom, GSM, and VoIP must obtain a GSM Operating License or Fixed Line License from the Information and Communication Technologies Authority to operate legally.

- Import/Export: Businesses engaged in international trade may require additional customs licenses and permits.

- Tourism: Hotels, tour operators, and other tourism-related businesses must obtain a Tourism Operating Certificate or TURSAB Certificate from the Ministry of Culture and Tourism.

- Manufacturing/Production: Manufacturing companies must obtain a Production Facility License under the Environmental Law, which includes at least one of the following: air emissions, noise pollution, wastewater discharge, and deep-sea pollution.

FAQs About Company Registration in Turkey

If you’d like to turn your new business into a company in Turkey or decided to extened your existing business, you’ll be relieved to know the Company Formation Process in Turkey is quick ,

You may do company formation as ON-LINE yourself or by prox, But, due to the complexity of the system and the need for a wet signature to ensure registration, we recommend that you get professional support from a Turkish Accountant or Turkish CPA.

Company registration has been doing on MERSIS system as on-line but we highly recommend to get professional service from a Turkish Accountant or Turkish CPA to avoid any legal problem due to both its complicated structure and some bureaucratic procedures.

Individual Shareholders must provide followings to incorporate a company in Turkey;

• In Turkish translation of passport which is approved by Notery in Turkey or appostiled Turkish Consulate where you based in

• A biometric of founders

• A GSM no & e-mail address of founders

• A Power of Attorney which is approved by Notary in Turkey or apostilled Turkish Consulate where you based in

• Tax number of company and founders

• Rent agreement of company

• Residance address of founders

The registration process typically takes between 1 to 2 weeks, depending on the completeness of the documentation and the efficiency of the local Trade Registry Office.

If you form your company through A&M Consulting Co. the application takes around hour to complete.

Yes, foreign individuals and entities can own 100% of a company in Turkey. There are no restrictions on foreign ownership.

As per Turkish trade code the capital must be paid off within 24 month for all company types, it may be paid off in once or can be paid in pieces,

But; there is a significant point for Joint Stock Company type what is 1/4 of the capital have to be paid to bank account by shareholders just before registration of it.

Yes it is

Almost for all activities the virtual office is available but do not forget that the physical office is mondatory for productors and some other sectors.

It costs about EUR 3,500 to form a company through A&M Consulting Co. This price includes the bank account.

That is our turn-key price and there are no hidden or any other additional costs to form a ready-to-trade a company with us.

Every company is legally required to have a accountant or CPA who are authorized by Turkish Finance Ministry which bookkeeps of company’s official books and declerates tax & SSI decleration forms, so without these a company cannot be active and maintained in Turkey

You can start trading as soon as your company has been formed. The system automatically sends your registration informations also to the tax office.

Once you have get your Trade Registration Certificate & Tax Signboard, it means that your company exists anymore and ready to trade and issuing invoice.

No, you must get the work or residence permit

No it isn’t necessary

You can set up and manage your company remote via an Turkish CPA who has Power of Attorney behalf on you.

The liquidation process is not as simple and fast as establishment, as it is a rather complex and long process, it must be carried out under the guidance of a Turkish Accountant or Turkish Financial Advisor, it takes at least 6 months.

If your company has a paid-in capital of at least 100.000,00 TRL and employs at least 5 local workers, you can apply for a work permit in Turkey,

For more information, you can check out our article on Turkey Work Visa

Corporate Income Tax (CIT): The normal corporate tax rate in Turkey is 25% as of July 2023.

Provisional Tax: Provisional tax is calculated at 25% on earnings every three months within the 12-month taxation year, and it is deducted from the annual tax(CIT)

Value-Added Tax (VAT): Most products and services are subject to the regular VAT rate of 20%. Basic food items are subject to 1% VAT, while there are also 8% and 10% VAT rates applicable in Turkey.

Income Tax: Income tax is levied on earnings by sole proprietorship companies and employees. Employers are responsible for calculating and paying the income tax of their employees. It is a progressive tax, ranging from 15% to 40%.

Stamp Tax: Stamp tax is calculated on all kinds of contracts and employee wage slips. It has a variable rate depending on the type of document. Employers are responsible for calculating and paying stamp tax for their employees.

Withholding Tax (WHT): Withholding tax is calculated at least 20% on workplace rent and wage payments.

For more information, you can take a look at our article on Taxation in Turkey

Turkish government offers several employment incentives & tax reductions . Incentives and tax reductions generally cover the IT and manufacturing sectors, Technology Development Zones and Free-Zone companies. Subsidies for research and development activities. Employment incentives are aimed at young, female skilled workers

LTD – LLC Company

In Turkey, you can register various types of companies, including:

- Limited Liability Company (LLC)

- Joint Stock Company (JSC)

- Branch Office

- Liaison Office

- Commandite Company

- Collective Company

In Turkey, you can register various types of companies, including:

- Limited Liability Company (LLC)

- Joint Stock Company (JSC)

- Branch Office

- Liaison Office

- Commandite Company

- Collective Company

The process generally involves the following steps:

- Drafting the company’s Articles of Association.

- Depositing a percentage of the capital in a bank account for JSC type

- Registering the company with the Trade Registry Office.

- Obtaining a tax identification number.

- Registering with the Social Security Institution.

- Notifying the relevant local municipality.

Key documents include:

- Articles of Association.

- Passports of foreign shareholders and directors.

- Proof of address for shareholders and directors.

- Bank receipt for capital deposit for JSC type

- Signature declarations of the directors.

No, you do not need a local partner or director to register a company in Turkey. However, having a local representative can be beneficial for administrative purposes.

Yes, certain industries such as banking, insurance, telecommunications, health, property brokers and pharmaceuticals require special licenses and regulatory approvals.

Yes, after registering your company, you can open a corporate bank account in Turkey. Most banks require the company’s registration documents, tax identification number, and personal identification of the directors and shareholders.For more detail, look at our article about Corporate Bank Account in Turkey

Companies must:

- File annual financial statements.

- Submit quarterly and annual tax returns.

- Maintain accurate and up-to-date accounting records.

- Register any changes in company structure with the Trade Registry.

A well-equipped Turkish Accountant will provide you with these

Setup Your Company in Turkey with A&M Consulting Co.

A&M Consulting Co. as a Turkish Accounting Firm specializes on end to end performing business incorporation in Turkey for particularly foreign investors and corporate companies in Turkey and conducts theirs Company set up in Turkey and Accounting and Bookkeeping Services in Turkey. We’re beside you to ease the process of accounting & bookkeeping for companies like you and help formation your company in Turkey.

DISCOVER OUR SERVICES:

- Company Registration in Turkey

- Tax Services

- Accounting & Bookeeping Services

- HR & Payroll Services

- Business Consultancy for Turkey

- Social Security Registration

- Virtual Office & Legal Address in Turkey

- Turkish Citizenship

- Turkey Work Visa

- Turkiye Tech Visa

- Establishment of Association in Turkey

- Foundation Registration in Turkey

- Company Winding Up in Turkey

You can reach out to our experienced consultans via email or by filling out the Contact Form on our website’s contact page